As market dynamics shift and customer preferences evolve, more solar installers are adopting third-party ownership (TPO) models like leases and power purchase agreements (PPAs), instead of offering cash or traditional loan-based solar purchases. This trend isn’t just customer-driven; it reflects broader economic, regulatory, and operational factors affecting how solar companies do business today.

Below, we break down the reasons behind this shift, supported by industry data, and explain how proposal tools like Artemis help installers adapt in real-time.

What Are TPO and PPA Models?

TPO (Third-Party Ownership): A third party owns the solar system, and the homeowner pays a fixed monthly lease for using the system.

PPA (Power Purchase Agreement): The customer pays per kWh for the electricity the system produces—again, without owning the panels.

Both models shift ownership and maintenance responsibilities away from the homeowner, lowering financial and operational barriers.

The Shift Toward TPO and PPA: What the Data Says

1. Customer Affordability Pressures Are Driving TPO Growth

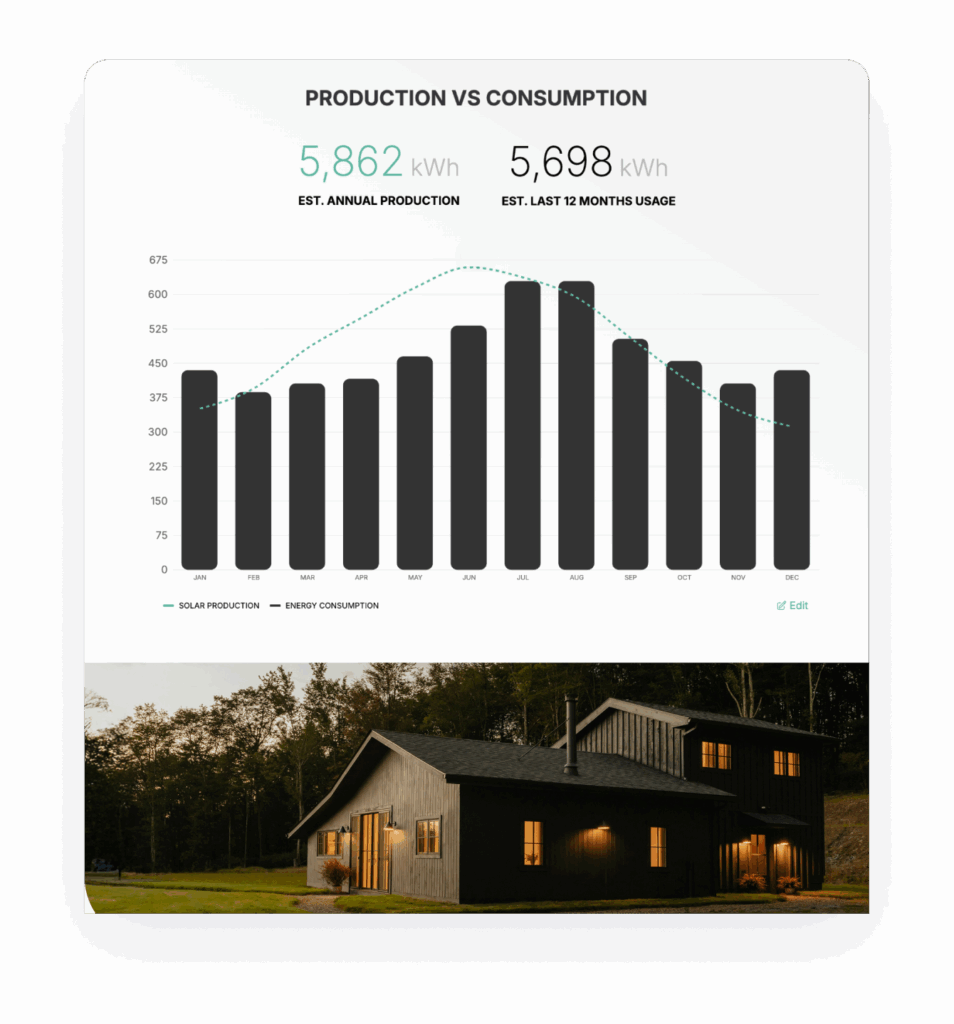

High interest rates and inflation are making cash deals and loans less attractive to homeowners. According to data from the U.S. Department of Energy, 62% of residential solar systems installed in 2023 were financed through third-party ownership models like leases or PPAs — a significant increase from just 39% in 2020.

TPO structures remove upfront costs entirely, which appeals to cost-sensitive homeowners, especially in regions where electricity rates are rising.

2. Credit Score Requirements Are Less Restrictive

Traditional solar loans often require credit scores above 680–700. By contrast, many TPO/PPA providers accept lower credit thresholds or use utility payment history instead. According to the Lawrence Berkeley National Laboratory, this flexibility allows a broader portion of the population to access solar, expanding the eligible market by up to 40% in some regions.

Installers looking to close more deals in underserved or lower-credit ZIP codes often lean on TPO models to avoid loan rejections that can stall projects.

3. Installer Cash Flow and Speed-to-Install Improve

In a cash or loan scenario, installers wait for customer payment or financing approval. With TPO, funding typically flows from the third-party owner, who provides milestone-based payments—improving company liquidity and reducing project delays.

This also reduces risk and overhead: The system owner handles maintenance, warranties, and production guarantees. According to the National Renewable Energy Laboratory (NREL), installers working with TPO partners can cut soft costs by up to 20%, primarily due to streamlined contracting and lower risk of cancellation.

Why Solar Companies Are Embracing TPO/PPA Strategically

Easier Proposal Workflows

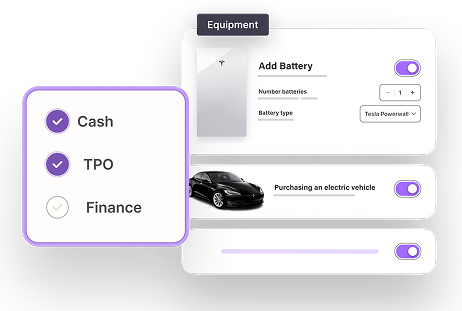

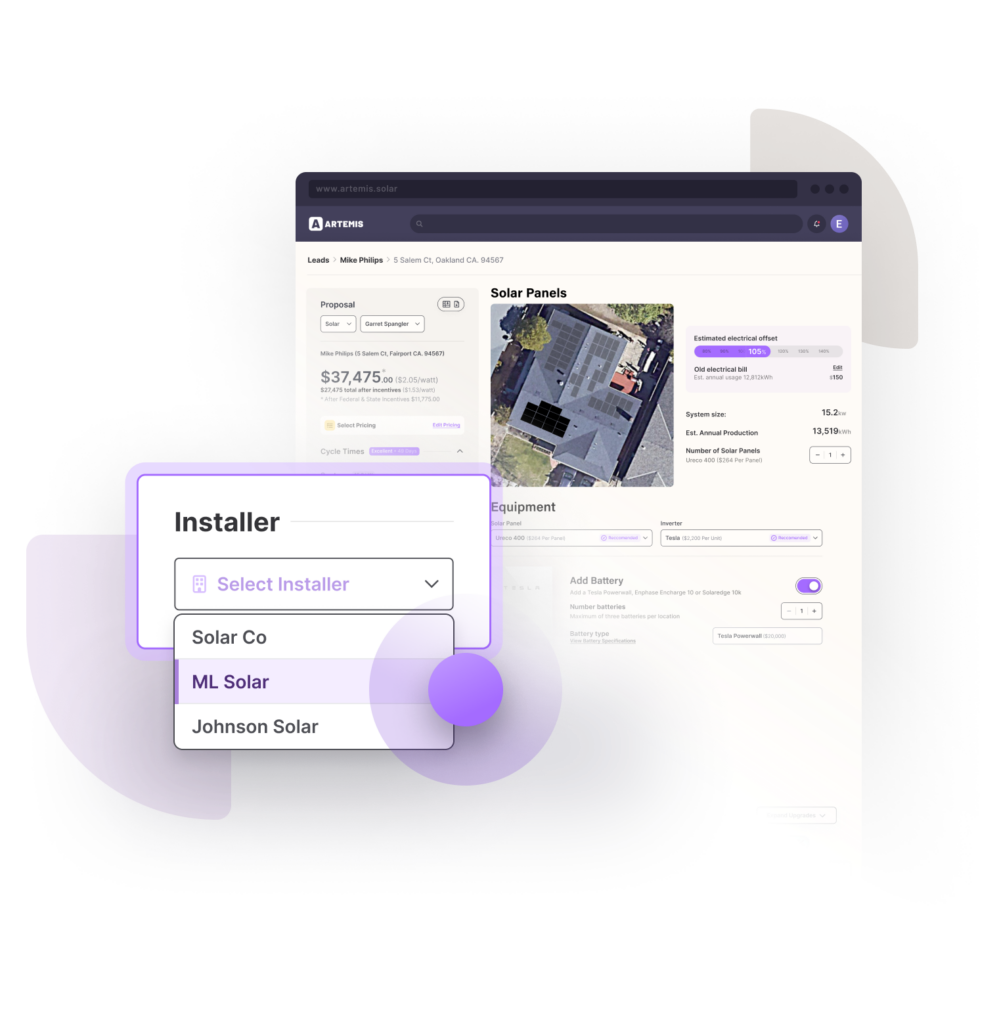

Offering multiple ownership options increases complexity and proposal tools must support it. For example, Artemis automatically generates proposals with TPO, PPA, cash, and loan pricing in one platform, updating rates in real-time based on ZIP code, utility, and incentives. With instant proposal generation under 15 seconds, installers can present side-by-side ownership comparisons during the first sales call—a major advantage when customer trust and clarity are on the line.

Embedded Quotes = Less Dropoff

Cash deals require explanation. Loan rates shift. TPOs have their own approval flows. Managing this across multiple lead sources and reps is operationally heavy without software support.

Artemis includes native financing integrations with a growing list of financiers, so reps can quote accurate PPA/kWh rates and monthly lease payments without switching tools. For inbound leads, the Artemis Embed Tool lets customers explore pricing and ownership models on their own, helping qualify them before a sales rep ever gets involved.

Fewer Errors, Lower Proposal Costs

Companies switching to TPO often juggle more documents: disclosures, permits, and lender paperwork. With Artemis, installers cut proposal costs by 75% by using templated workflows and unlimited revisions—ideal for high-volume teams that quote multiple ownership options.

A Market Responding to Cost, Credit, and Speed

- Reach more homeowners by removing credit and cost barriers

- Improve cash flow with third-party milestone payments

- Reduce cancellations and simplify maintenance

- Close deals faster with instant, flexible pricing options

Tools like Artemis help streamline the transition by offering real-time pricing, integrated financing, and instant proposal generation. For solar companies operating in competitive markets, this adaptability isn’t just useful—it’s becoming essential.