The residential solar market has scaled quickly, but the customer experience hasn’t. While industries like auto and retail have shifted to ecommerce, most solar companies still rely on manual quoting, outbound reps, and delayed follow-ups.

This disconnect between how homeowners want to buy—and how solar companies sell—creates friction, drives up soft costs, and slows growth.

The Gap Between Sales and Software

Most Websites Still Don’t Quote

Solar lead gen is mostly built around forms, not functionality. Visitors enter their contact info and wait for a call. No pricing. No system preview. No instant proposal.

According to Lawrence Berkeley National Laboratory, 66% of residential systems are sold through direct installer channels—most of which still depend on sales reps, not online tools (Berkeley Lab).

Proposal Timelines Still Take Hours

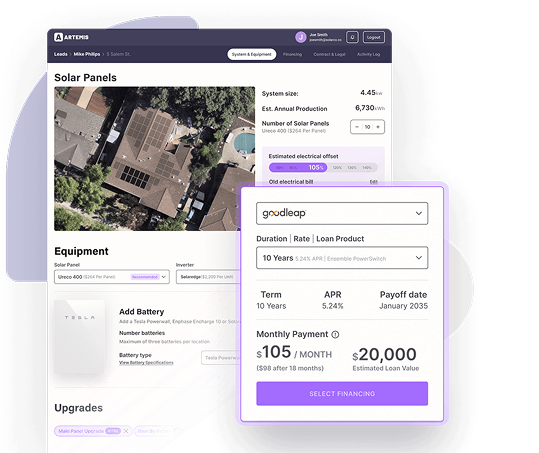

Proposal creation is often treated like a back-office task. Even with design software, sales teams wait on revisions, loan integrations, or multiple handoffs before a customer sees numbers.

Soft costs—including design and customer acquisition—make up more than 65% of total residential system cost, per the National Renewable Energy Laboratory (NREL). Proposal delays are a core driver.

Most Tools Still Rely on Generic Assumptions

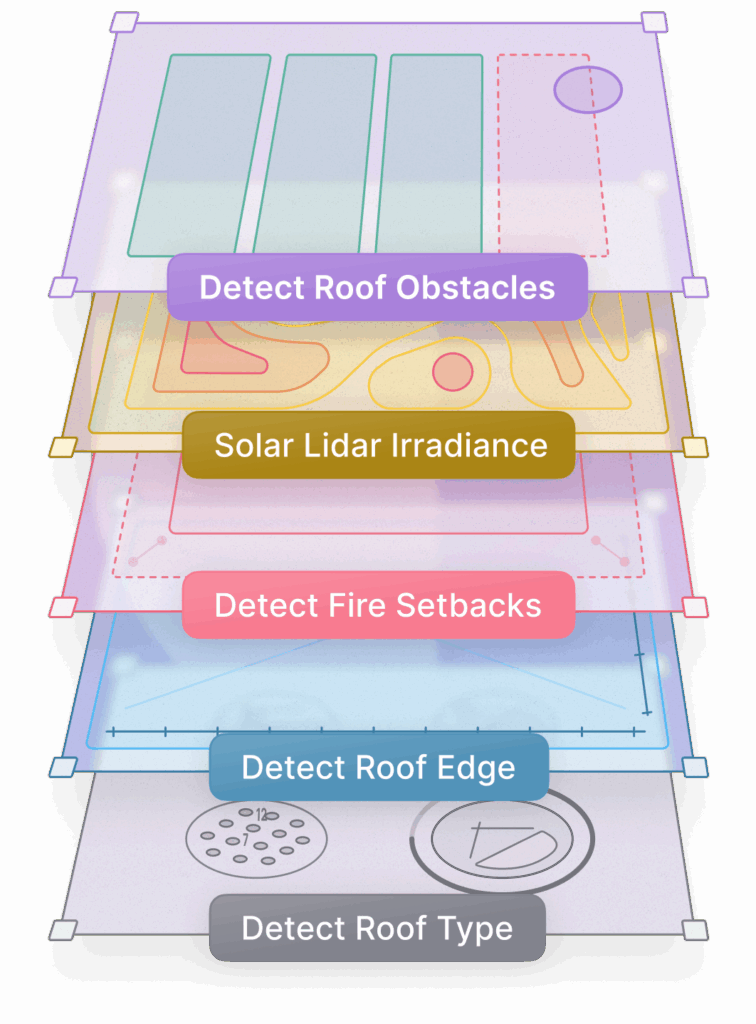

One reason the solar industry hasn’t embraced ecommerce isn’t lack of demand—it’s lack of infrastructure. Most quoting tools still rely on low-resolution imagery, outdated irradiance maps, and generic roof calculations.

That’s not enough to deliver a financing-ready quote instantly. These tools might give a ballpark system size or cost, but they aren’t accurate enough to satisfy lenders—or sales teams that need to close on the spot.

Until recently, there was no true instant design engine that could generate a layout based on real rooftop geometry, shade analysis, and fire setbacks in under a minute. Without that, self-serve quoting couldn’t scale.

Consumer Expectations Have Shifted

Buyers Expect Self-Service

79% of U.S. adults shop online. More than 60% have bought high-ticket items—furniture, appliances, even cars—without speaking to a rep (Pew Research).

Solar is still treated differently. But for most homeowners, that’s not a feature. It’s a friction point.

Most Research Happens Before the Call

McKinsey reports that over 70% of buyers want to research products online before ever talking to someone (McKinsey). If solar websites don’t show system options or pricing upfront, they’re not part of the early decision window.

That’s a missed opportunity—and a preventable one.

Operational Roadblocks

Even with rising demand for online tools, adoption has lagged. A few reasons why:

- Permitting and utility rules vary by region

- Many sales orgs still rely on legacy quoting workflows

- Some companies worry that self-serve tools expose internal pricing

But teams that move past these hurdles are seeing the upside. One G2 reviewer wrote:

“Before, our reps had to go back and forth to get a quote approved. Now, we can design and generate proposals in seconds, and the customer sees the numbers right away. It’s drastically reduced our turnaround time.”

Conclusion

Ecommerce is standard in nearly every major industry. Solar isn’t there yet—but it’s headed in that direction.

The biggest blocker hasn’t been mindset. It’s been tools. Accurate design, instant quoting, and lender-ready outputs haven’t been available—until now.

As consumer behavior continues to shift toward speed, transparency, and self-service, installers that adopt online quoting and design infrastructure will be better positioned to grow.