When you’re selling solar, speed and trust are everything. That’s why Artemis doesn’t just deliver 3D-rendered proposals in under 15 seconds—it also bakes critical decision-making tools directly into the sales experience. One of those tools? Soft credit checks.

Let’s walk through how they work within the Artemis sales flow—and why they’re a game-changer for your solar business.

What Is a Soft Credit Check?

Before diving into Artemis-specific functionality, here’s a quick refresher: a soft credit check is a non-intrusive way to review a homeowner’s credit profile. Unlike a hard credit inquiry, a soft pull doesn’t affect the customer’s credit score and doesn’t show up on their credit report as a formal inquiry. That means it’s fast, low-risk, and perfect for early-stage financing discussions.

Why Soft Pulls Matter in Solar Sales

In residential solar sales, most customers rely on financing—whether it’s loans, leases, or TPO (third-party ownership). But traditionally, financing approvals required formal paperwork and hard pulls, which delayed deals and introduced friction into the sales process.

With Artemis, that’s no longer the case.

By enabling sales reps to run soft credit checks directly within the proposal tool, Artemis ensures:

- Faster approvals: reps can confirm eligibility while still on the call or at the door.

- Higher close rates: by removing guesswork and delays around financing.

- Better customer experience: by offering clarity without risk to credit scores.

Where It Fits in the Artemis Sales Flow

- Proposal Generation in Seconds

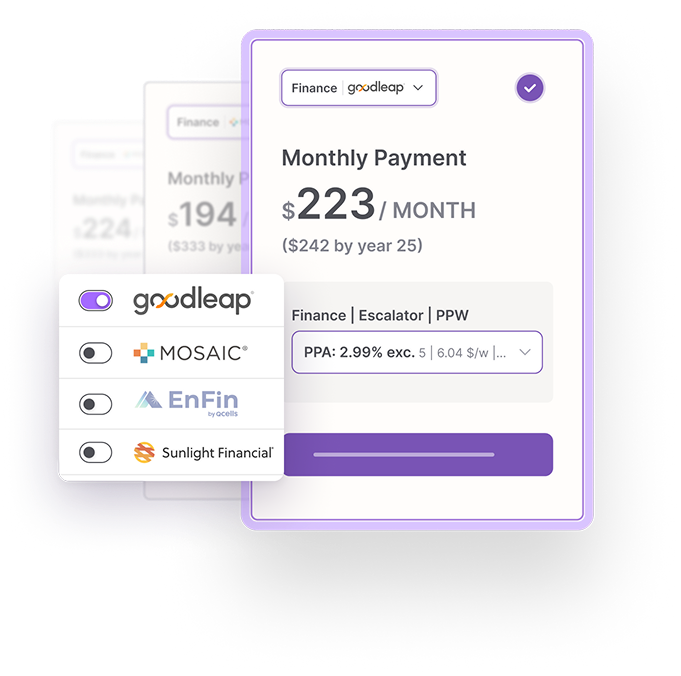

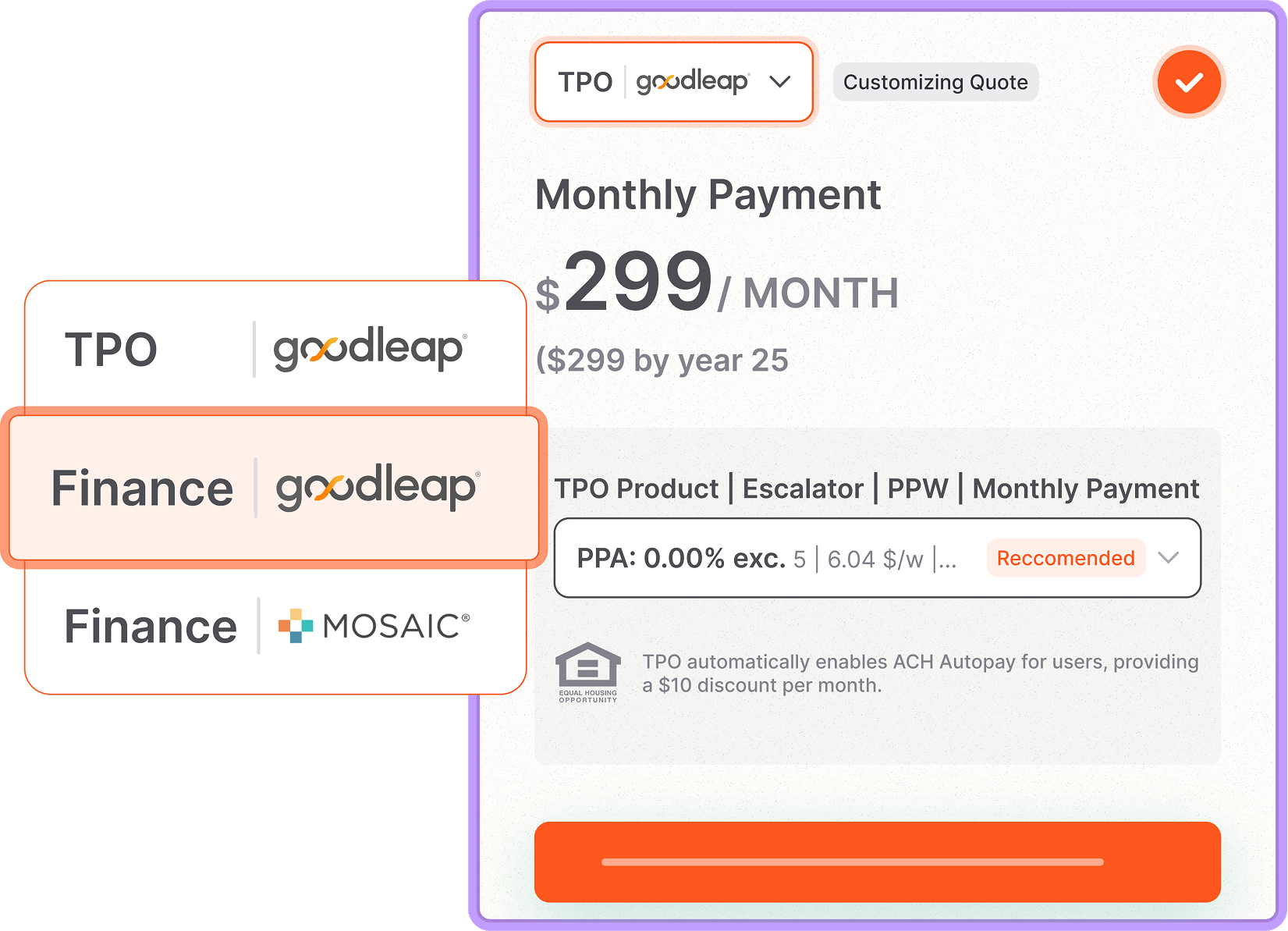

The moment a rep enters a customer’s address, Artemis uses AI to generate a fire-compliant solar design in under 15 seconds. This includes solar irradiance, setbacks, and even shade analysis. - Real-Time Financing Comparison

As part of the proposal, Artemis allows reps to compare financing options from top lenders—side-by-side, in real time. Whether it’s cash, loan, or TPO, the tool updates monthly payments and savings instantly. - Soft Credit Check Execution

With one click, the rep can initiate a soft pull through integrated partners like Goodleap, Mosaic, or Sunlight. Because Artemis is already TPO-approved and embedded with certified lenders, the tool ensures that only eligible financing options are shown.

The result? No need to leave the proposal. No awkward follow-ups. Just frictionless financing visibility. - Customer-Facing Presentation Mode

With Artemis’s presentation mode, reps can walk customers through financing options on screen—live and dynamically updated based on their credit eligibility. It builds trust and accelerates decisions on the spot.

Security, Compliance & Trust

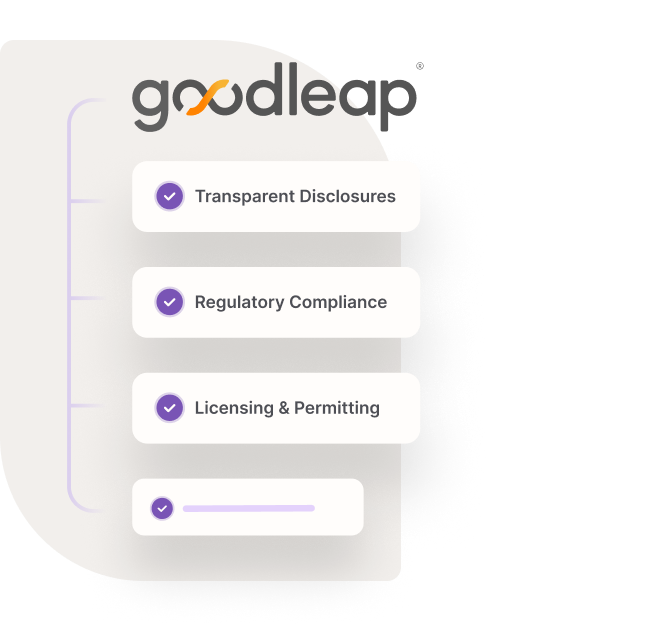

Running credit checks inside a sales tool may sound risky—but Artemis was built with security and compliance at its core. Here’s how it safeguards your business and customers:

- Compliant Soft Pulls: Artemis only uses soft pulls, so there’s no credit score impact.

- Verified Financing Partners: All financing options presented are approved by industry leaders.

- Data Privacy: Customer data is never repurposed or shared beyond the credit-check workflow.

Benefits for Sales Teams

The biggest win? Empowerment. With Artemis’s soft credit check functionality, your sales team can:

- Close more deals, same-day: No waiting for approvals or callbacks.

- Sell with confidence: Know immediately what financing is available.

- Reduce friction: Make proposals, edits, and approvals all from the same interface.

It’s the ultimate sales enablement tool—purpose-built for modern solar teams.

At Artemis, we believe solar sales should feel like modern e-commerce: fast, transparent, and seamless. By integrating soft credit checks directly into the proposal flow, we remove yet another barrier between intention and action.

It’s not just about qualifying buyers—it’s about giving them confidence to say “yes” faster.